A Candid Look for Today’s Buyers

Let’s be honest—if you’ve been looking at homes lately, you’ve probably felt the shock. Prices are sky-high, mortgage rates are stubbornly elevated, and the math just doesn’t seem to work for most households right now.

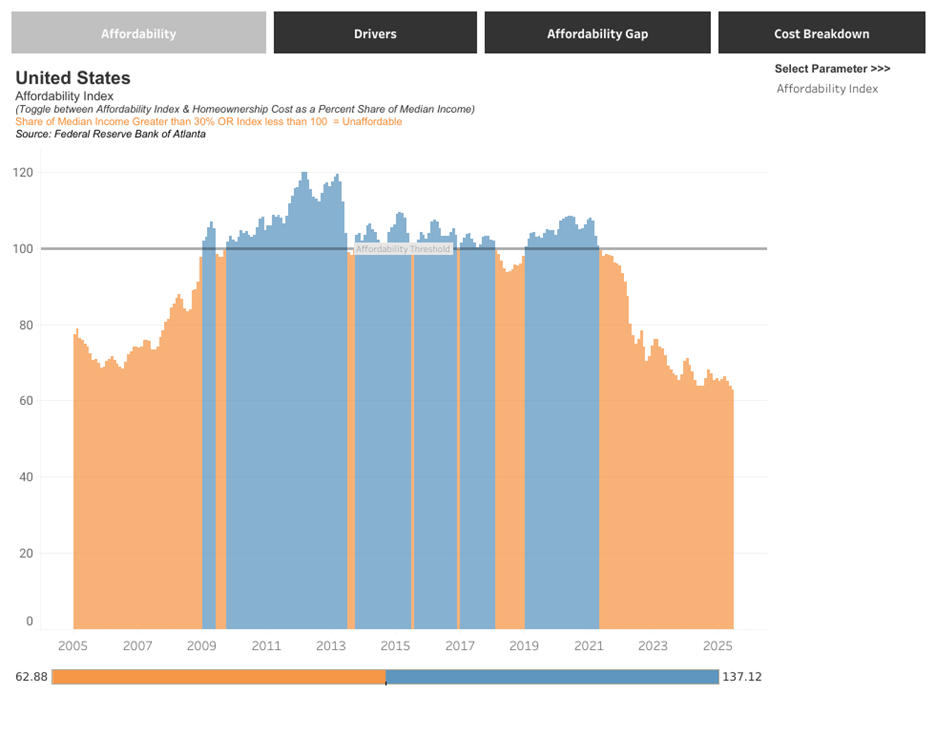

You’re not imagining it. National home affordability is at its lowest point in decades. The monthly payment for a median-priced home is now far above what a median-income family can comfortably afford. And it’s not just one thing driving this—it’s a perfect storm years in the making.

Atlanta Federal Reserve Affordability Index:

How We Got Here

When COVID hit, the Federal Reserve acted fast—slashing rates to near zero—and the federal government poured stimulus into the economy. That made money cheap, demand surged, and people started rethinking where and how they wanted to live.

Many young adults moved out of parents’ homes, remote workers sought more space, and investors bought homes as long-term assets. Immigration surged after the pandemic, adding even more households in search of affordable places to live.

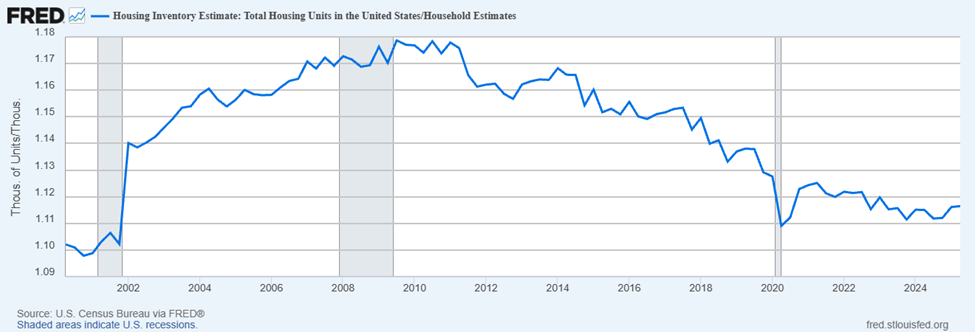

But here’s the catch: since the 2008–2009 financial crisis, we’ve never really built enough homes to keep up with demand. Builders were cautious, banks were conservative, and when demand spiked after the pandemic, we didn’t have enough supply to meet it. Prices did what prices always do in that scenario—they jumped.

Number of Housing Units Available Per Household:

The Post-Pandemic Economy Didn’t Ease the Pressure

The job market boomed. Wages grew. Stock prices climbed, boosting buying power for some, especially those who benefited from the tech and AI boom. But those wins weren’t spread evenly—many households were priced out even as others bid up the market.

Where Things Stand Today

The good news? Price growth is slowing. Some local markets are even seeing small declines. Inventory is creeping higher as immigration flows normalize and more multifamily buildings hit the market.

The not-so-good news? Mortgage rates may stay higher for longer. Even with the Fed likely to cut short-term rates as the economy cools, mortgage rates move more with long-term bond yields—and those are being driven higher by federal deficits, softer foreign demand for U.S. debt, and questions about our fiscal future. In other words, a small dip in rates is possible, but a return to the 3%–4% mortgages of the pandemic era is unlikely soon.

What This Means for Affordability

Affordability will improve slowly, but probably for reasons that don’t feel great—rising unemployment and softer demand. Without a big boost in housing supply (especially at the entry level), buying will remain tough for the average family. And while real estate is local—meaning some areas will see relief sooner than others—big picture trends will still set the tone nationwide.

What You Can Do

In a market this complex, timing your next move—and making sure it’s right for you—matters more than ever. There are still opportunities out there, but they require a clear strategy based on your own finances, your local market, and your long-term goals.

If you’re wondering what this all means for you personally—whether you should buy, wait, refinance, or explore investment opportunities—talk with a Vindicta Investment Advisor. We can walk you through where the market is headed, how interest rate trends could impact your budget, and what strategies make the most sense for your situation. Get in touch today, and let’s build a plan that works for you in this market.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own situation before making any investment decision.